Why stocks are down today sounds like an important thing to know, but is it?

What we're really asking why the overall stock market is down today, and this is something that doesn't really matter in the long run.

Let me tell you why.

Why Stocks Are Down Today

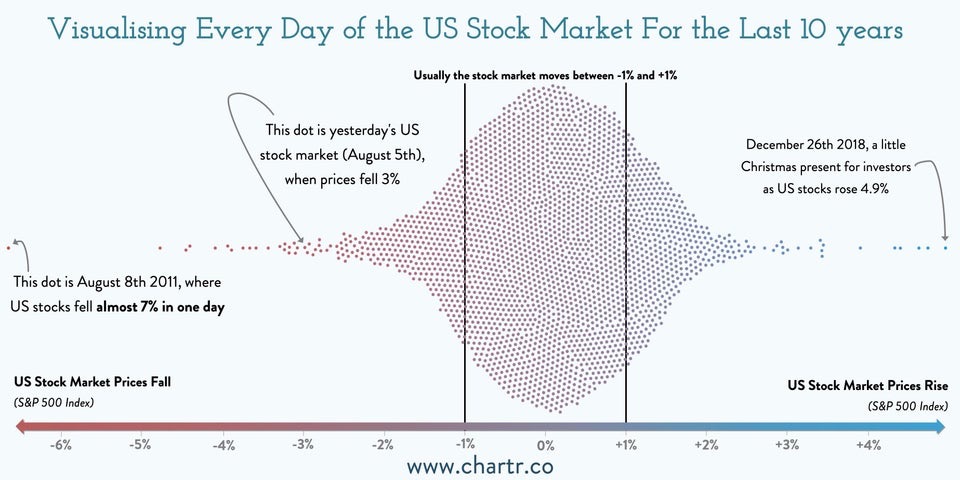

70% of the days the stock market moves between +1% and -1%, 20% of the days the stock market moves between +2 and -2%, and 10% of the time the market moves +3% or -3%, as the graph below shows.

Was there a particular reason for each of those moves?

If you're to believe the traditional finance media, you'd definitely think so, as there's always someone who says they know what is causing today's move.

"It's the unemployment numbers"

"It's the rising oil prices"

"Elon Musk farted"

In the end, no one knows for sure, as it is simply the aggregate result of the actions of millions of investors buying and selling individual stocks, and this is wholly unpredictable.

The only thing we can say with reasonable certainty is that over time, the overall market trend is up.

Why It Doesn't Matter Why Stocks Are Down Today For Index Investors

If you're an index investor, you might think it is important to keep a close eye on the movements of the S&P 500.

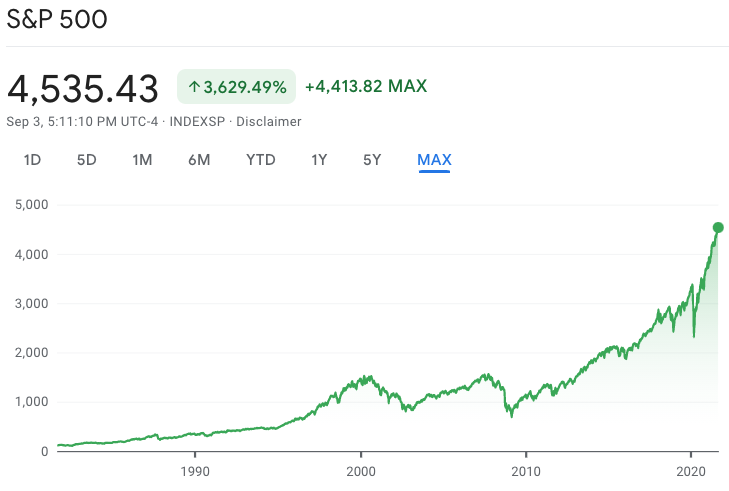

However, index investing is a way to play the fact that in the long run, the overall stock market has always gone up and up.

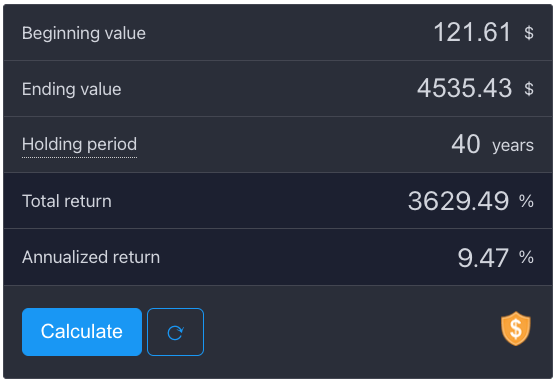

In fact, the annualized return over the past 40 years for the S&P 500 is a very respectable 9.47%!

So as an index investor, you can simply dollar-cost average your way to a handsome 9% annual return, without having to worry about the day-to-day movements of the stock market, but only if you play the long game.

This is why legendary investor Warren Buffett recommends index investing for most people:

In my view, for most people, the best thing to do is to own the S&P 500 index fund.

Why It Also Doesn't Matter For Stock Pickers

Now, not everyone wants to invest in an index.

I, for one, prefer to buy individual companies when they are on sale, in a so far successful attempt to outperform the index.

And in this case as well, the master stock picker Buffett tells us to ignore why the stock market is down today, as it is irrelevant:

Ignore the stock market, ignore the economy, and buy a business you understand.

Instead, we should focus on buying great businesses when they are on sale, and then hold on for dear life through the ups and downs of the market, because in the long run this will provide the best possible returns.

An added benefit is that you don't have to be glued to your screen, as it is more akin to a fire-and-forget type of investing, which means you'll sleep much better at night.

If you want to learn more about this strategy, check out the recommended reading section on my resources page.

Are you able to ignore the day to day market swings, and why? Let me know in the comments.