You have found a good business with a high return on equity, low debt levels, healthy profit margins and a steadily increasing book value? Great, then it is now time to calculate the company's intrinsic value to determine whether the stock price is low enough to invest!

The following quote provides a definition of the term intrinsic value.

"[Intrinsic value is] the discounted value of the cash that can be taken out of a business during its remaining life."

Warren Buffett in Berkshire Hathaway Owner Manual

So the intrinsic value is the net present value (NPV) of the sum of all future free cash flows (FCF) the company will generate during its existence. This intrinsic value reflects how much the business underlying the stock is actually worth if you would sell off the whole business and all of its assets.

Value investors make money by buying good businesses at a price way below the intrinsic value.

The idea behind this is that in the short term the market often produces irrational prices, but in the long term the market will on average price the stocks correctly. So if you buy when the price is irrationally low and sell when the price approaches the intrinsic value (the correct price), you will earn market beating returns while taking less risk!

You can read more about the difference between price and value by clicking here.

Discounted Cash Flow method

To calculate the intrinsic value of a stock using the discounted cash flow method, you will have to do the following:

- Take the free cash flow of year 1 and multiply it with the expected growth rate

- Then calculate the NPV of these cash flows by dividing it by the discount rate

- Project the cash flows 10 years into the future and repeat steps 1 and 2 for all these years

- Add up all the NPV's of the free cash flows

- Multiply the 10th year with 12 to get the sell off value*

- Add up the values from steps 4, 5, and Cash & Cash Equivalents to arrive at the intrinsic value for the entire company

- Simply divide this number with the number of shares outstanding to arrive at the intrinsic value per share

Is the current stock price much lower than the intrinsic value per share you calculated? Then you might consider investing.

However, take into account that the intrinsic value you calculated is merely an estimate, and that small changes in inputs can lead to significant changes in the estimate. So do not take the calculated value as true, but merely as a rough indication.

* For this calculation we assume that the company and all its assets will be sold in year 10 at a free cash flow multiple of between 12 and 15. This is because it is impossible to predict the future, especially more than 10 years ahead.

Free Discounted Cash Flow calculator

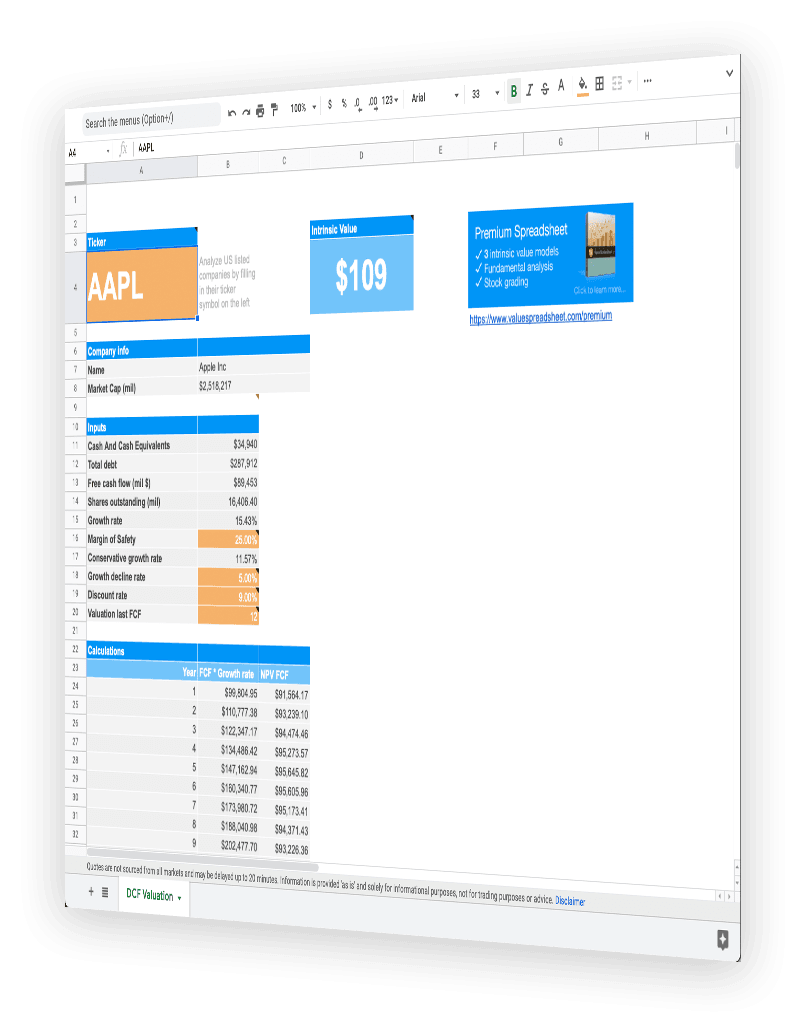

To make life a bit easier for you, I created an automated discounted cash flow spreadsheet which you can use to quickly calculate the intrinsic value of US listed companies.

And the best thing is that all you have to do is fill in the ticker symbol and the spreadsheet will do the rest!

Sounds good? Then click the button below to get access!

Other valuation models

While DCF is one of the most common ways to calculate the intrinsic value of a company, there are other good methods available that can help you get a more accurate picture.

Since calculating the intrinsic value of a company is more art than science (you just can't precisely determine the value, it is always an estimate), it is recommended to use multiple methods and then compare the results.

Read my Easy Intrinsic Value Formula post for a method which is based on P/E instead of FCF, for example.

For a comprehensive explanation of 3 distinct valuation models, leave your name and email below to receive my free How to Value Stocks ebook.

Advanced intrinsic value calculations

If you want more advanced functionalities, you might consider my PREMIUM value investing spreadsheet