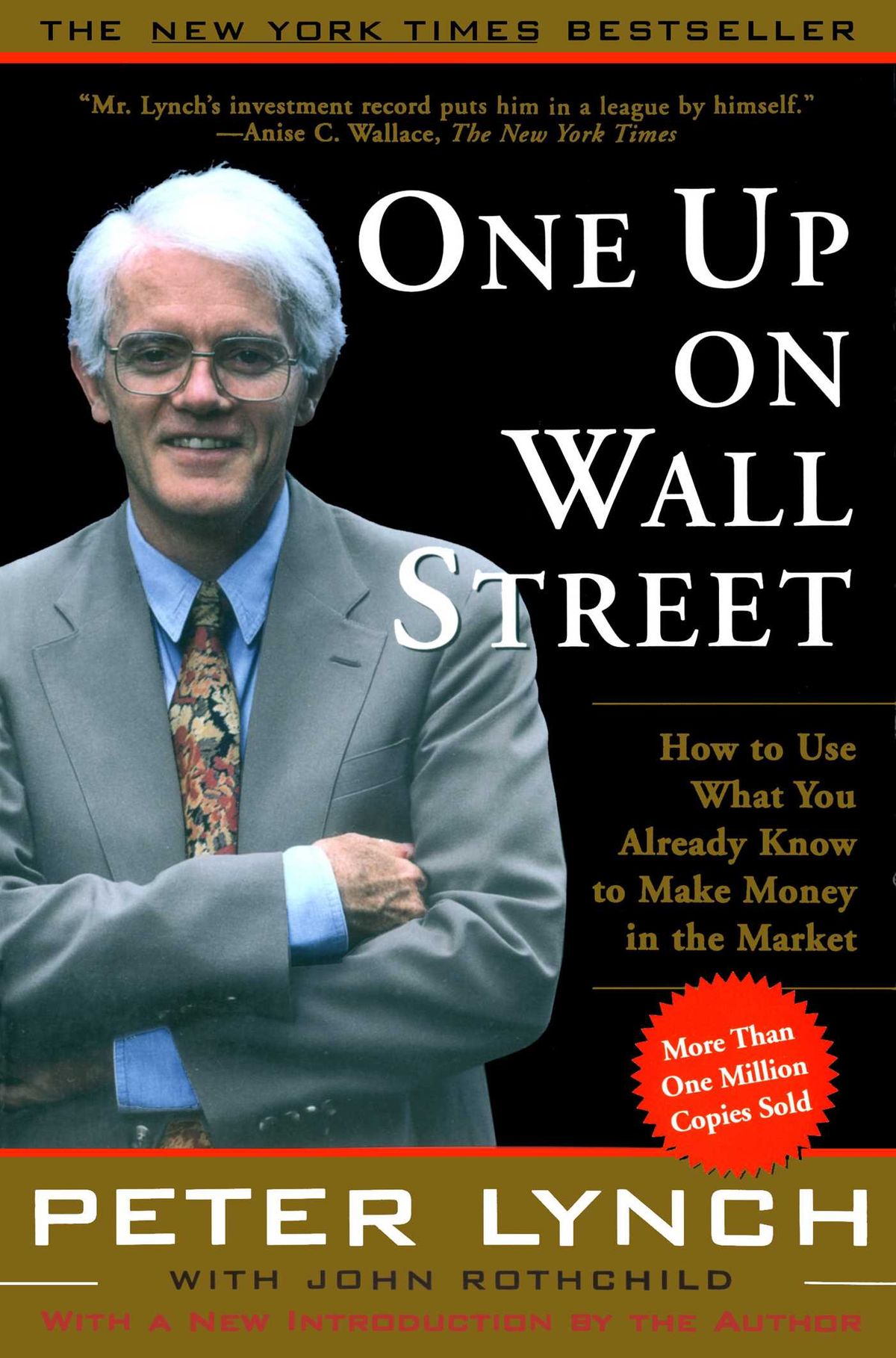

One of the best books ever written on investing by one of the best investors who ever lived, is One Up On Wall Street by Peter Lynch.

In that book, he has a brilliant little chapter titled The Twelve Silliest (and Most Dangerous) Things People Say About Stock Prices.

And while Lynch’s book was published over 30 years ago, the same silly and dangerous things are still repeated till this very day.

That’s why I will share them with you here, and update them for today’s world, so you don’t fall into these common traps.

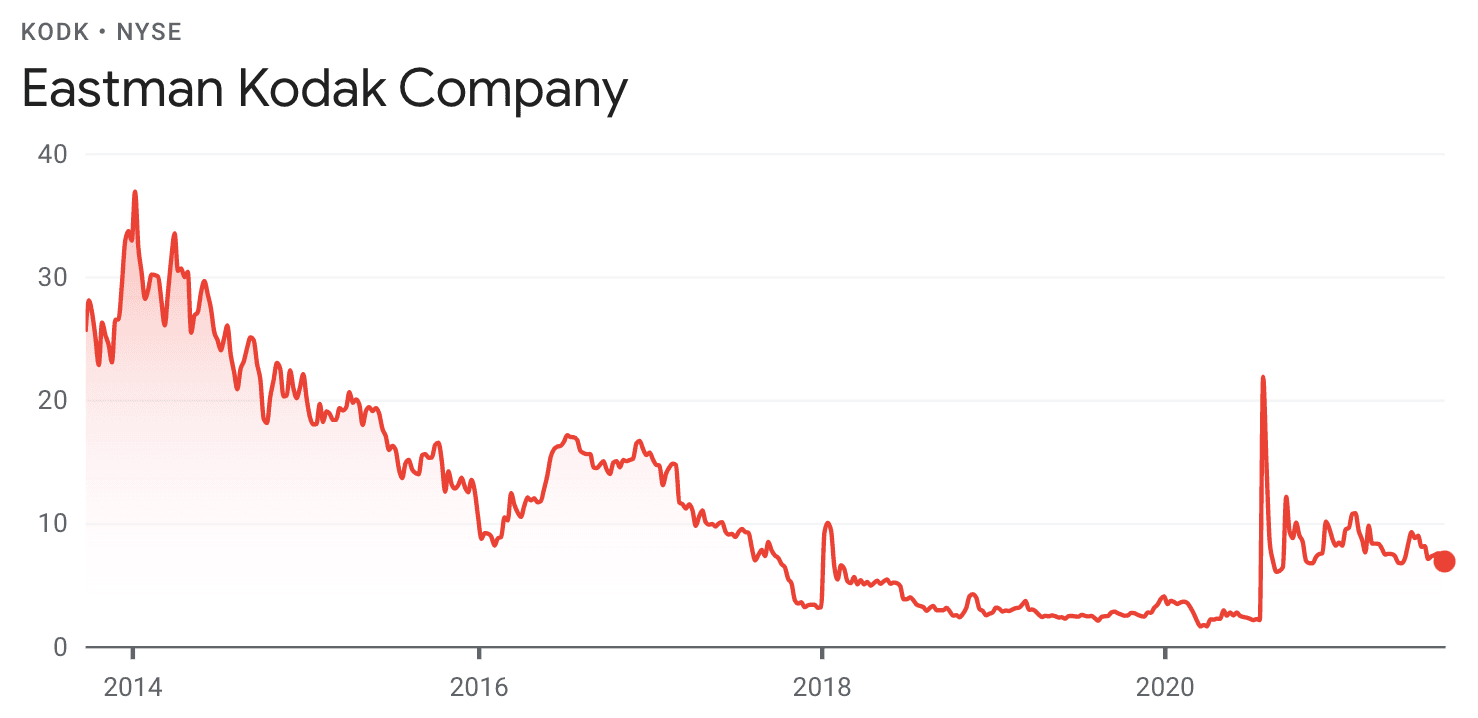

1. If It’s Gone Down This Much Already, It Can’t Go Much Lower

Before Eastman Kodak (KODK) turned into a meme stock and got a small boost from that, its shares dropped from $36 in 2014 to just $1.60 in 2020, a 95% drop!!

When it first hit $20, people were saying “it can’t possibly go any lower”, but it did.

Again, and again, and again.

In theory, a stock price can go down to zero, and only when it reaches that point, it really can’t go any lower.

Until then, all bets are off, and anything can happen in the short run, even for companies with great balance sheets (aka not Kodak), because people don’t always act rationally when it comes to investing.

2. You Can Always Tell When A Stock’s Hit Bottom

Everyone, including yours truly, loves to try and buy stocks at their lowest possible price, but this usually backfires.

Trying to buy a stock whose price is dropping rapidly is like catching a falling knife; it can hurt you.

This happened to me recently with The A2 Milk Company (A2M.AU), once a stock market darling that encountered some trouble selling their products in China due to COVID restrictions, resulting in a 50% haircut from $20 to $10.

I was confident the stock would bottom out around $10, but boy was I wrong…

The stock kept falling at the same pace and soon reached a low of $5.04, another 50% off!!

It then wiggled between $5 and $6 for a while, and according to Lynch, this is what you want to wait for before you dive in:

What usually happens is that a stock sort of vibrates itself out before it starts up again.

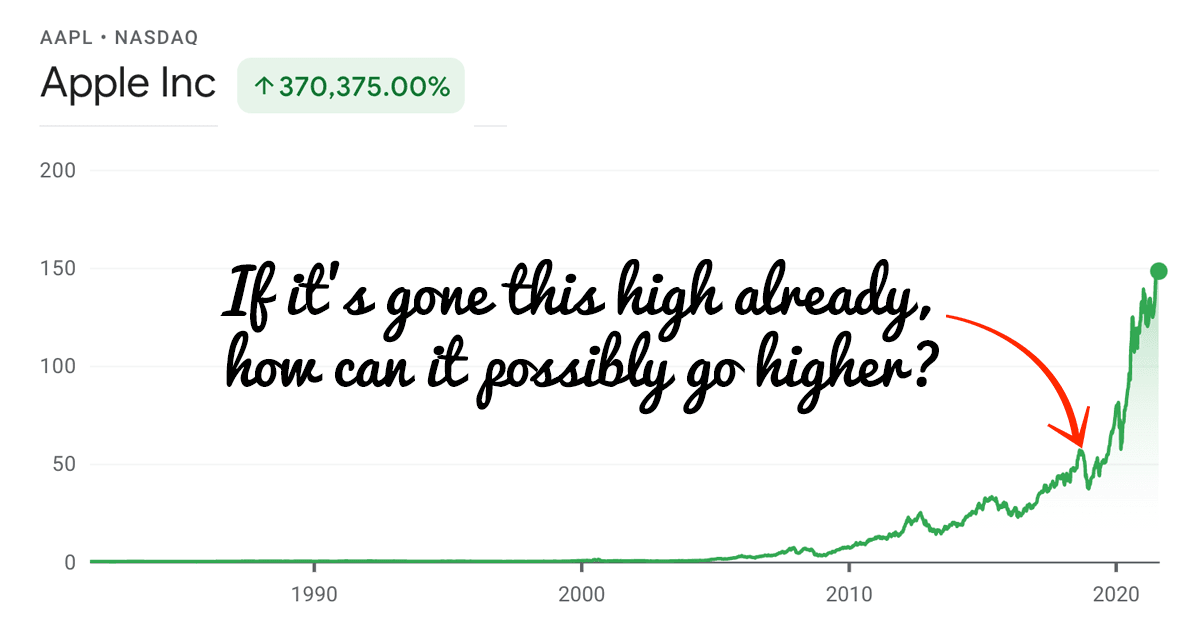

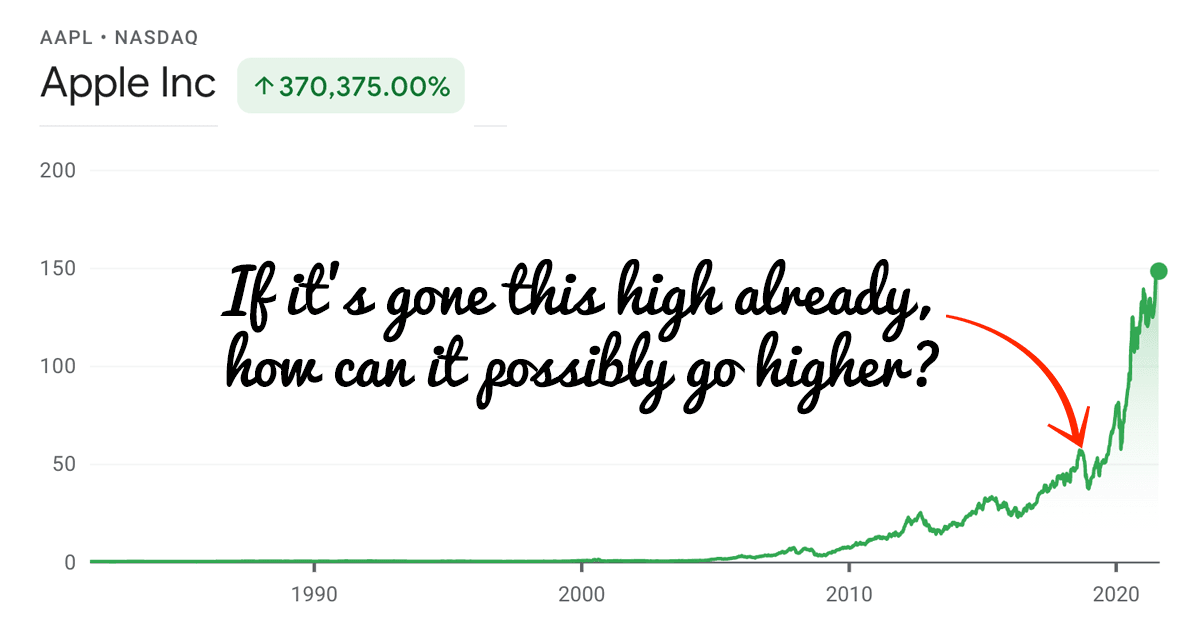

3. If It’s Gone This High Already, How Can It Possibly Go Higher?

So many people have told me they sell half their stock when it has doubled, because then what’s left in there is “free”, except it is not, because you might be missing out on another doubling or two with the other half.

Finding continuously growing companies is hard, and once you find them, you should increase your stake, not decrease it, and then hold on for dear life.

Since 1981, McDonalds (MCD) shares have gone up 342 times (!!), meaning every $1000 invested would have turned into $342.000!

Apple (AAPL) has been on a similarly impressive tour de force over the years, just look at the hockey stick graph below.

But I bet many people along the way up wanted to “lock in profits”, thinking it could not possibly go any higher, and they would have missed out on some mind boggling returns.

I feel the same is happening today with Tesla (TSLA).

Yes, their stock price increased rapidly, but people forget it almost flatlined for a decade before that, and right now every quarter they show more and more profitability, have two factories that still need to start production, have an unassailable technological lead that is accelerating, have the best engineers in the world working for them, have the EV trend on their side, and are sitting on a huge pile of cash, so is there really no way they can go any higher in the next few years?

If a stock has doubled or more and you think about selling it, re-check the fundamentals and the growth prospects, and only sell if there is really no way they can go any higher.

4. It’s Only $3 A Share: What Can I Lose?

Talking about stocks with people who have no experience investing, this one always comes up.

They seem to think that a $3 stock is cheaper and less risky than a $30 stock.

The problem here is that the price of a stock says NOTHING about how cheap a stock is, because the price can only be cheap relative to the intrinsic value of the underlying company.

If a share in a company has a price of $30 but a value of $60, this is a much better deal than a stock with a price of $3 and a value of $1.

Also, if the $30 stock did a 10:1 stock split, it would now also be trading for a price of $3, so is it now “cheaper”?

No, because it's still the exact same company, only split up into smaller pieces.

As to risk, you have exactly as much to lose on a stock with a high price versus one with a low price, as they can both go to zero, and so both can cause you to lose 100% of your money.

5. Eventually They Always Come Back

I love to exaggerate, to the annoyance of my wife, and so I use the term “always” loosely when I speak, but things hardly ever happen “always”, especially when it comes to stocks.

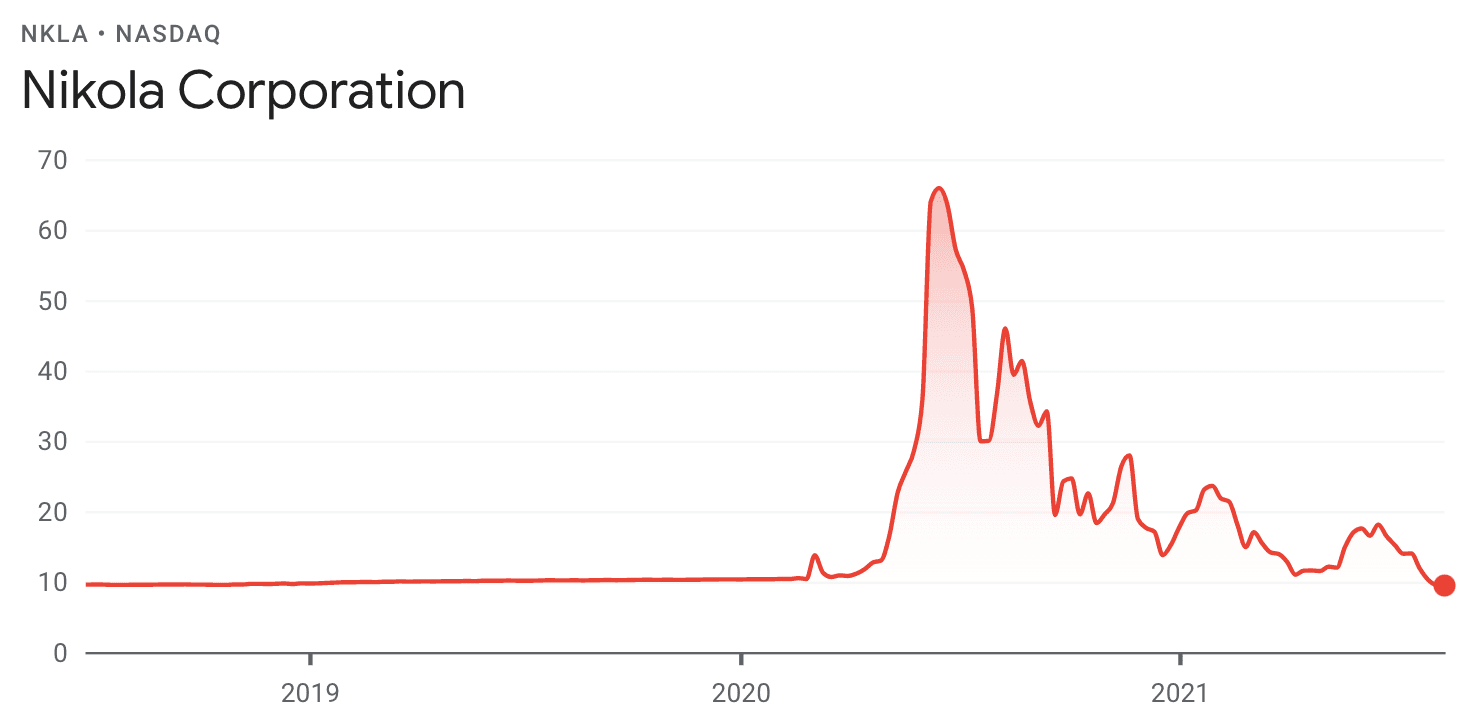

Kodak isn’t coming back, neither is a fluff company like Nikola (NKLA), and neither are the countless companies that have gone bankrupt over time.

Peter Lynch had this to say about it:

When you consider the thousands of bankrupt companies, plus the solvent companies that never regain their former prosperity, plus the companies that get bought out at prices far below the all-time highs, you can begin to see the weakness in the ‘they always come back’ argument

Stock prices don’t always bounce back.

They only will if the underlying company continues to grow and perform well.

6. It’s Always Darkest Before The Dawn

“Buy when there is blood in the streets” is a famous Warren Buffett quote, which has worked extremely well for me in the past.

For example, during the start of the pandemic the stock market plummeted due to fear and uncertainty, which was further compounded by an oil crisis.

A perfect storm to pick up great companies for bargain prices, which resulted in several multi-baggers for me.

However, not all companies rebounded, and well known names like Hertz, J.C. Penney, and Virgin Atlantic actually filed for bankruptcy during this time.

Sometimes it’s always darkest before the dawn, but then again, sometimes it’s always darkest before pitch black. - Peter Lynch

7. When It Rebounds to $10, I’ll Sell

Stocks that drop in price due to serious trouble at the company might never rebound, and you will be stuck for years hoping to sell it at a price that minimizes your losses.

However, sometimes you will just have to put your big boy/girl pants on and swallow the bitter pill; you made a sub-par investment, and you should take whatever is left and run.

You do NOT have to earn back the money the same way you lost it.

You might be better off taking a loss and reinvesting the leftovers in a healthier, more promising company.

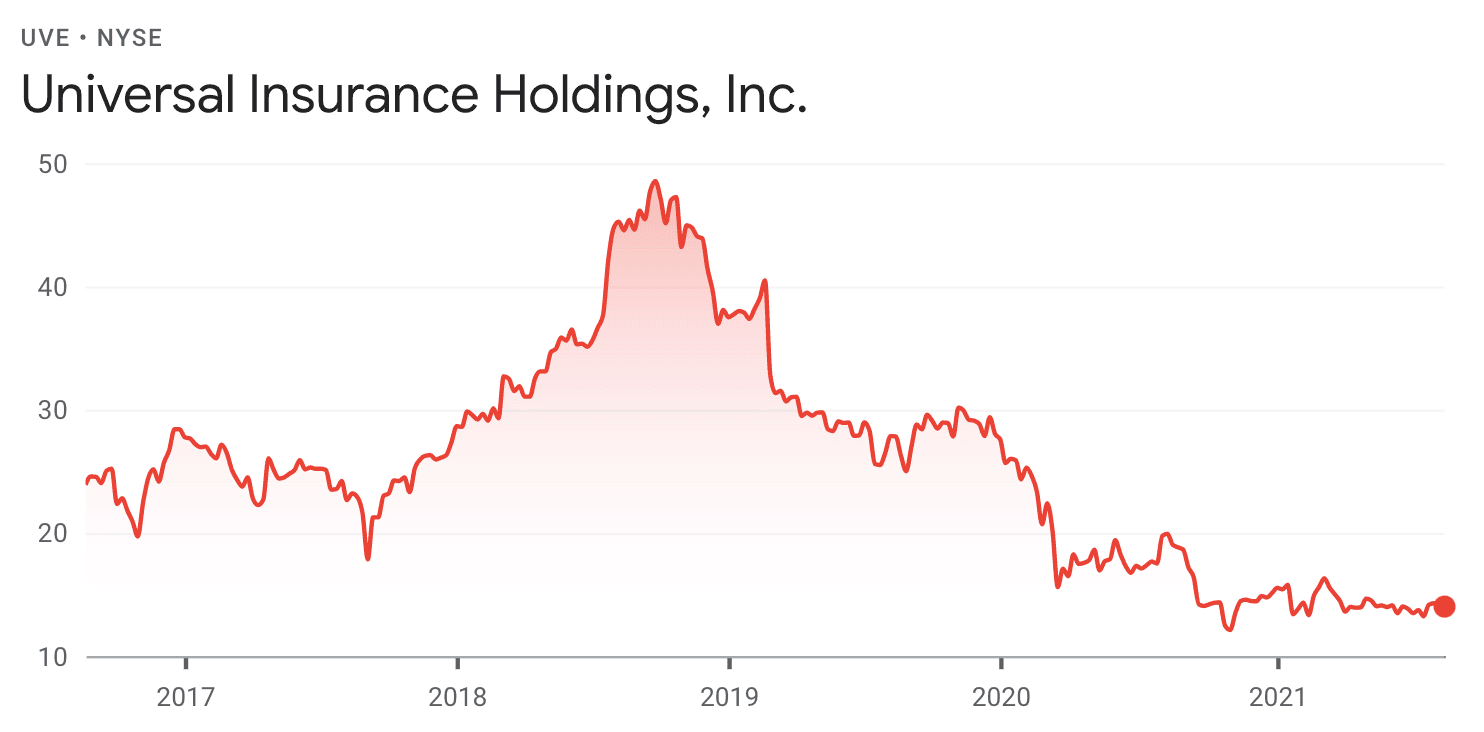

I just had to do this with United Insurance Holdings (UVE), which earned me a 175% return in the past, but when I bought it again a few years later, it went down significantly as profits decreased, and then hovered around $14 for the better part of a year.

I paid too much for it, and had to get out and reinvest it in something that actually has the potential to double or more.

8. What Me Worry? Conservative Stocks Don’t Fluctuate Much

Investors seeking a steady dividend income tend to gravitate towards large, established companies, like oil companies or utilities, as they are deemed to be “safe investments”.

It is important to realize, though, that most companies only pay dividends because they have no better use for their money.

They are not innovative enough to spend it on lucrative R&D and future growth, but instead just chug along as usual, with only minor improvements here and there.

Often, this makes such companies complacent and ripe for disruption, which is not such a “safe” position to be in at all.

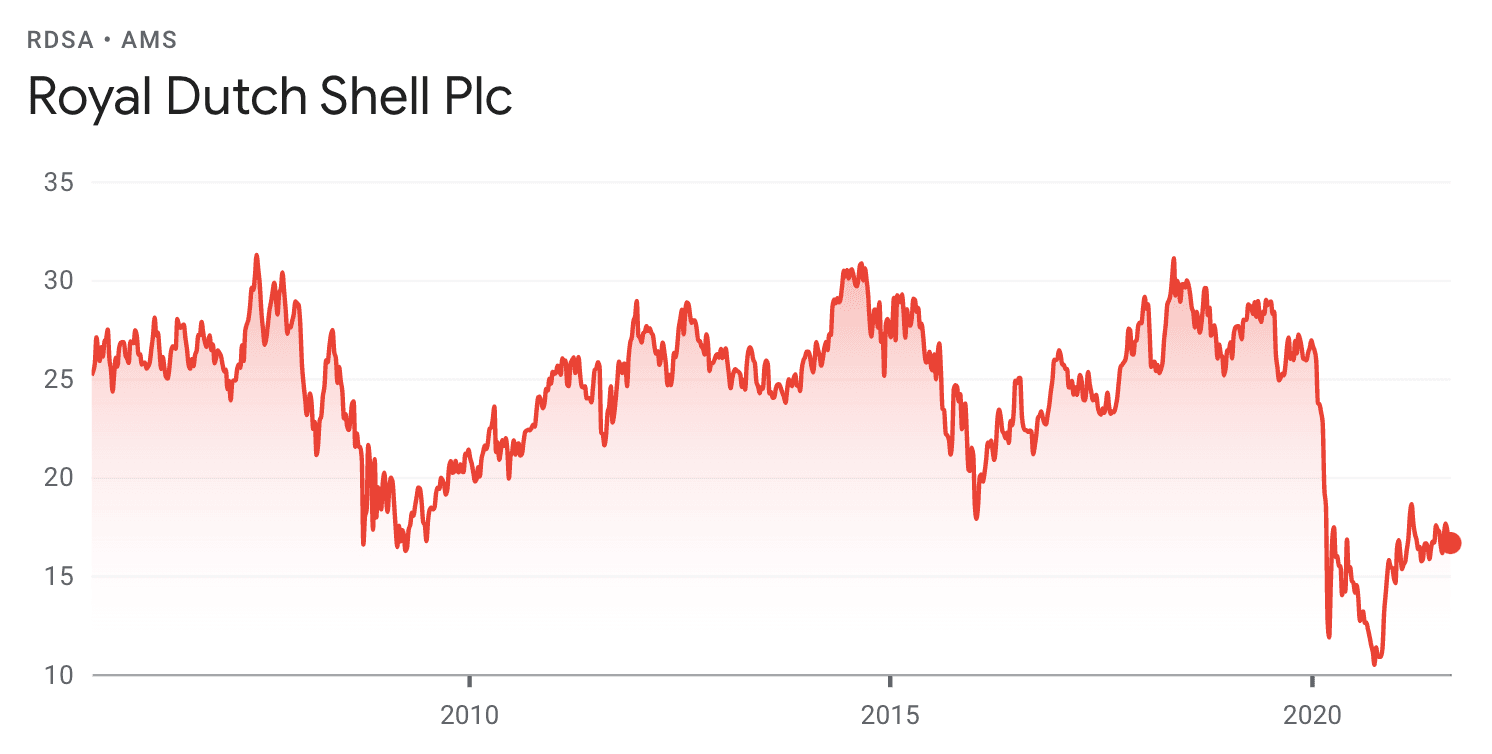

One of my uncles was talking to me about stocks and said: “oil stocks are always a good idea, right, nice and steady.”

Well if you look at the long term chart of Royal Dutch Shell (RDSA), you see the stock fell from €30 in 2007 to just €17 in 2009, and again from €30 in 2014 to €20 in 2016, and from €28 in 2018 to a mere €10 in 2021.

Quite a bumpy ride.

There are simply no inherently “safe” stocks whose price will not fluctuate much.

Bad things can always happen, and over time, they usually do, so don’t be complacent.

9. It’s Taking Too Long For Anything To Ever Happen

Some stocks can move sideways for years on end, despite growing their earnings and making great progress.

It is hard to stick with a stock like this, because you feel nothing will ever happen.

It takes remarkable patience to hold on to a stock in a company that excites you, but which everybody else seems to ignore. You begin to think everybody else is right and you are wrong. But where the fundamentals are promising, patience is often rewarded. - Peter Lynch

Let me show you Tesla (TSLA) as a prime example; a decade of nothing, then finally people started to realize they were on to something, and the price skyrocketed!

I’ve used the analogy of pushing a ball under water, where the pressure is building up year after year, and when the market finally realizes how crazy low the price actually is compared to the company’s earnings and prospects, it’s like letting go of the ball and watching it fly out of the pool.

So be patient if you believe in your investment thesis.

10. Look At All The Money I’ve Lost: I Didn’t Buy It!

However much it may suck to see stocks you considered buying multiply in price, you shouldn’t constantly beat yourself up for these missed opportunities.

It is counter-productive.

You didn’t actually lose any money by not investing; that money is still in your bank account.

The productive thing to do is to focus on finding the next great opportunity, and making sure you don’t make the same mistake again.

But be wary not to make any rash decisions just to make up for past misses.

I watched a documentary about Bitcoin several years ago, and thought: “hmm, that’s kind of interesting, let me set up a wallet and buy a couple just for fun.”

However, it was a little tricky back then to set up a wallet, and so I never actually bought any Bitcoin.

I beat myself up for this for a while, thinking about how much money I could have made, but then I realized this was going to keep happening, and that I should focus on opportunities in the future instead of whining about missed ones in the past.

11. I Missed That One, I’ll Catch The Next One

How often have you heard people say: “I missed buying Netflix at a low price, but I’ll catch the next one.”

What they mean, is that they’ll buy “the next Netflix” or “the next Google”, which most likely will not be as good as the original one.

This holds true especially for technology companies, as the first to reach a critical mass will have the strongest network effects and data lead.

It is much more profitable in the long run to buy exceptional companies like Google at a higher price, than a mediocre business at a bargain price.

Even after they 10x’ed between 2004 and 2015, Google stock has since doubled another 4 times!!

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price. ~ Warren Buffett

12. The Stock’s Gone Up, So I Must Be Right, Or… The Stock’s Gone Down, So I Must Be Wrong

If you buy a stock at $10, and within a month it is at $11, what do you say to yourself?

Most likely, you’ll give yourself a pat on the shoulder for picking a winning stock.

Peter Lynch mentions that this is one of the most common fallacies when it comes to investing in stocks, and I am most definitely guilty of this as well.

The truth is that short term price movements say very little about a stock’s long term performance.

So unless you’re a short-term trader who’s happy with a quick 10% gain, it says very little about your investment thesis being right or wrong.

All it tells you is that someone is willing to pay a bit more or less for the very same slice of a company.

It will usually take at least 3-5 years for long term investments to pan out, and only then will you be able to say: “I did a great job picking this multi-bagger!”

Don’t get cocky, though ;-)

Concluding Remarks

I’m quite certain that every single person reading this article will be able to relate to at least one or more of these misconceptions.

In the end, we’re all human, and we’re all born with the same cognitive biases.

However, being aware of them is the first line of defense against committing these sometimes costly mistakes.

So with that said, I hope this article will have alerted you to these 12 dangerous thoughts, and my hope is that they’ll save you from losing some money :-)

Do you know anyone who could benefit from these tips? Then click the share buttons!

And if you want to know which other books I recommend, besides the one from Peter Lynch, then check out my curated list of investment resources.

Have you ever caught yourself stepping into one of these traps? What was the result? I would love to hear your experiences.