You have studied the best investment strategies out there and you spend hours analyzing stocks. Still, you are unable to beat the market. Here is why.

We have all heard the tales of "experts" who perform worse than monkeys when it comes to picking stocks that will outperform the broader market index, and the average individual investor performs even worse. However, monkeys have an unfair advantage: they do not have a business degree, they do not follow the news, and they do not care about money!

While it seems logical that having more financial knowledge would lead to better results on the stock market, nothing seems further from the truth. In fact, a study by Lauren Willis concluded that "financial education appears to increase confidence without improving ability, leading to worse decisions". One of the main reason why overconfidence is a problem is because it leads people to believe they can time the market, which often leads to more frequent trading, which in turn means more transaction costs and thus significantly lower returns.

However, overconfidence is just one of the many factors which affect our ability to make logical decisions. Actually, the word "logical" is completely irrelevant when it comes to human decision making behavior. Just look up cognitive biases on Wikipedia and you get a several pages long list of psychological traits which cloud our rational judgment.

An entire field of research called Behavioral Finance has emerged to study how these biases affect our financial decision making. The findings in this field suggest that emotions and psychology profoundly influence our decisions, which in turn causes us humans to behave in irrational and unpredictable ways. Behavioral Finance goes straight against the established Efficient Market Theory, which assumes that people behave rationally, and on which many financial theories are based.

COMMON BIASES

So what can Behavioral Finance tell us about our investing behavior? To answer that question, let us quickly go through the most common and destructive cognitive biases which can hold you back from achieving market beating returns.

We start our little journey with a simple, yet powerful concept researched by Kahneman and Tversky called Prospect Theory. Their study, and many others afterwards, revealed that humans are in general risk-averse when it comes to managing their money. Subjects would rather take a certain $500 gain than a 50% chance to earn either $0 or $1000. When it comes to losses though, subjects were willing to take more risk to avoid having to take a loss. The reason why this behavior can ruin your returns on the stock market is because it causes people to sell winning stocks too early, while they keep holding on to losing stocks in the hope they will recover at some point, which means tremendous opportunity costs. This does not mean that you should sell as soon as the price starts declining though. However, to avoid holding on to losing stocks for too long, you have to be willing to pull the trigger and take a loss when there are fundamental problems with the underlying business. Have a clear selling strategy, and stick to it!

The availability bias is another interesting finding from the field of Behavioral Finance, which teaches us that people tend to value recent news more than older news. This creates a short term mindset, while investing is a long term process which requires patience. This bias also sets the stage for several other wealth-destroying tendencies, like overreaction to news, herd-behavior where people blindly follow the actions of the majority, and confirmation bias which makes people more likely to seek out information which supports their beliefs rather than information which is contradictory to their beliefs.

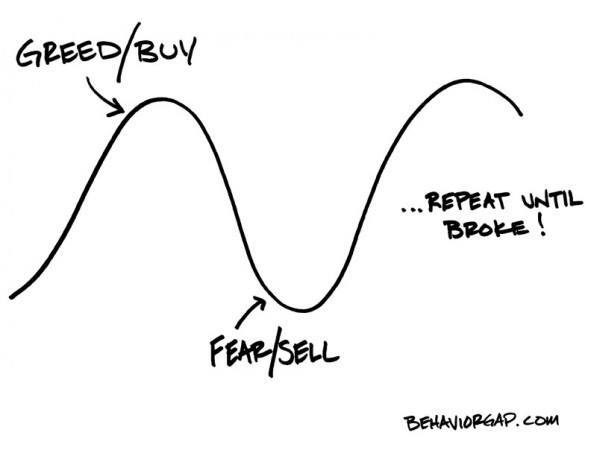

That is why Buffett tells us to be greedy when others are fearful, and fearful when others are greedy. This counter-intuitive way of thinking works, because when everyone believes a company is doing well people tend to exaggerate positive news, pushing the stock to unreasonably high levels which is doomed to fail at some point. But when people believe a company is doing bad, they will overreact to bad news, making the stock unreasonably cheap. This is the time to buy, because when the general public finally realizes their mistake, the stock price will return to reasonable levels again, earning you a handsome profit. The best way to avoid these biases is to tune down the daily dose of news you take in. This will make you significantly less likely to get caught up in irrational panic or euphoria. In addition, follow the advice of Mark Twain: “Whenever you find yourself on the side of the majority, it is time to pause and reflect.”

It should now be clear to you how these psychological tendencies can negatively affect your investment decisions. However, despite the fact that every person on earth is affected by these biases, some investors seem to be able to overcome or circumvent these cognitive limitations. It is this relatively small group of investors who is able to consistently beat the market. So what is it that separates these investment greats like John Templeton, Mohnish Pabrai, and Warren Buffett, from the average investor or Wall Street "expert"? The short answer: their mindset. Let me elaborate.

A STRONG FOUNDATION

There are short term trading strategies like technical analysis which are focused on historical prices, as well as speculative strategies like option and futures trading. These strategies all involve predicting short term price movements. However, we just learned that human behavior is highly irrational and therefore unpredictable, so it seems futile to even try. Therefore, a long term strategy offers you the best chance to achieve satisfactory returns on the stock market.

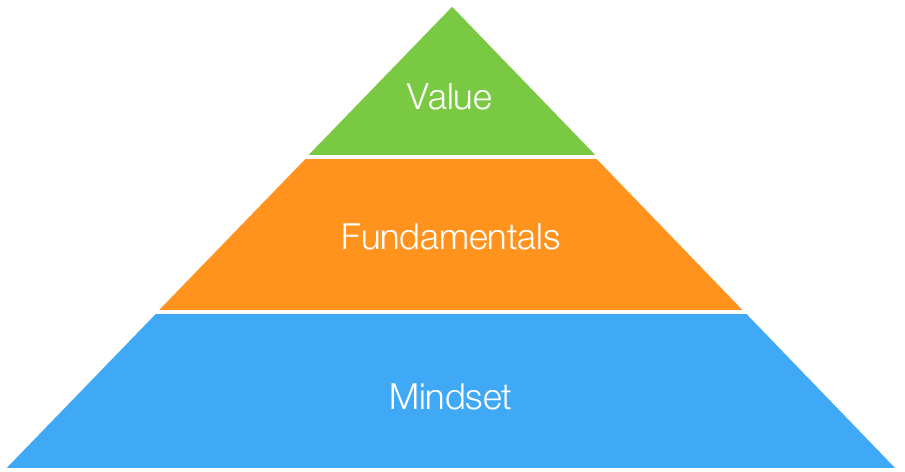

Long term strategies include investing in bonds or index funds. While these are perfectly fine ways to invest, you will at most earn the market return. Another option is to let others manage your money, for example through a mutual fund. Unfortunately, mutual fund managers have proven to be unable to perform better than the broader market. What remains is the only strategy which is able to consistently outperform the market while minimizing downside risk, value investing, which focuses on buying solid companies at a discount to their underlying business value. It is this strategy which has earned Warren Buffett a place in the top 3 richest people on earth.

Still, a house needs a strong foundation or it will come crumbling down, and the same goes for an investment strategy. The foundation in this case is the mindset of the investor. Warren Buffett would have been unable to amass his billions had he let his emotions influence his investment decisions. Because no matter how good your strategy is, if you are unaware of the way your mind works against you when it comes to investing, you will most likely fall prey to irrational behavior which is detrimental to your returns.

Figure 1. Your mindset is the foundation of a successful investment strategy.

CONCLUSION

To summarize, most people fail to beat the market, because their mind clouds their judgment. The importance of this notion cannot be understated, because your emotions have the power to render your financial education and investment strategy completely useless. This is why monkeys are able to beat Wall Street experts. Being aware of this fact is the first step towards better returns, for it allows you to take some counter-measures. These counter-measures include:

- Writing down a buy/sell plan in advance, and sticking to it

- Taking a loss once in a while (you don't have to tell anyone)

- Acknowledging that it is impossibru to time the market

- Trying to minimize trading

- Distancing yourself from hype and pessimism by following the news less closely

- Being fearful when others are greedy, and greedy when others are fearful

- BEING PATIENT!! Time is your friend on the stock market if you are not in a hurry

Also, only invest with money you won't need in the coming five years, so you are never forced to liquidate your investments at a less-than-optimal time. Finally, never invest with borrowed money to create leverage, it is not worth the risk and creates unnecessary stress.

Now that you know how to minimize the negative influence of your mind on your investment decisions, you are well on your way to those storied market beating returns. The next step is to find companies with bullet-proof financials which are trading at a significant discount to their underlying business value thanks to irrational behavior by the crowd. To get you started we wrote a free eBook which you can download here.